Stock Markets Bounce Back After Decline on Black Friday

STOCK MARKETS BOUNCE BACK AFTER BLACK FRIDAY DECLINE

Patrice Horner, CFPr, MBA, QFA Nov 29, 2021

Late last week, the markets hit a wall of worry after the Omicon covid virus declaration in South Africa. That was followed immediately by news that regions of the World were closing airport access to flights out of South Africa. Institutional investors expected another economic pullback. The Omicon variant is expected to be more contagious than Delta and perhaps not responsive to the current vaccine. Those expectations are being tested.

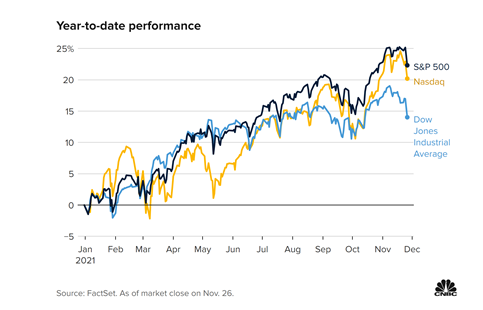

Stock markets had one of their largest daily declines for the year last Friday, around 2.5%. This Monday morning globally market indexes snapped back on the open as investors bought back equities. The breadth of the market rebound is more limited, led by interest rate sensitive sectors of Technology and Energy. This is due to thoughts that a slip in economic growth will postpone rate hikes. Cyclical stocks such as Consumer Discretionary and Real Estate rallied as well.

It was Black Friday in the US and a shortened trading day as part of the Thanksgiving holiday in U.S.. There tends to be light trading volumes on such day, which can amplify moves in the market. Monday’s rally has yet to recoup all of Friday’s drawback. Retail investors piled back into the S&P and NASDAQ Index ETFs. The S&P is 23% higher than 52 weeks ago. It is likely to be a volatile week and remainder of 2021. We continue to monitor the markets and recommend a balanced approach.

Previous performance is not a guarantee of future returns. All investments contain risk. Your particular portfolio should be designed to your level of risk and to target your financial goals. Review regularly. Senior Solutions Ltd (SSL) provides financial planning guidance for a fee. The client receives guidance to implement at their own discretion. SSL does not guarantee any returns from such guidance. SSL is not an investment manager, does not sell investment or insurance products, nor receives any commission or third-party compensation. SSL does not directly manage or custody assets on behalf of clients. SSL is a financial planning firm for select clients.